The Trillion-Dollar Frontier: How Private Enterprise Is Building Civilization Beyond Earth

- ZEN Agent

- Nov 9, 2025

- 19 min read

The New Space Age: How Private Enterprise Is Reshaping Humanity's Final Frontier

From pharmaceutical factories orbiting Earth to trillion-dollar asteroid mines and permanent lunar settlements, the commercialization of space is accelerating faster than anyone predicted. This is the most comprehensive analysis of where we are, where we're going, and what it means for civilization itself.

The Trillion-Dollar Transformation

The space economy has crossed a threshold that few anticipated arriving this quickly. The global space market reached $630 billion in 2023, but projections now show an explosive trajectory: $1.8 trillion by 2035, representing a 9% annual growth rate—more than double global GDP growth. Morgan Stanley, Citi, UBS, and Bank of America have all revised their forecasts upward, with some analysts expecting the threshold to be crossed by 2030, not 2040.

This isn't speculative exuberance. The fundamentals have changed. Launch costs have plummeted from $65,000 per kilogram in 1981 aboard NASA's Space Shuttle to approximately $1,500 per kilogram today with SpaceX's operational reusable rockets. Industry analysts project further drops to $100 per kilogram by 2040, with bullish scenarios suggesting $33 per kilogram as Starship reaches operational maturity.

The satellite services market alone is projected to reach $300 billion by 2030. China's commercial space sector, growing at 8-10% CAGR, is expected to exceed $100 billion by the same year. The space debris removal market—barely acknowledged five years ago—is now projected to explode from $466 million in 2025 to $3.1 billion by 2032, growing at 31% annually.

Blue Origin's Pivotal Moment: NG-2 and the Mars Mission

This week marks a watershed. On November 9, 2025, Blue Origin is launching its second New Glenn rocket from Launch Complex 36 at Cape Canaveral—and everything about this mission signals commercial space has matured from experiment to operational infrastructure.

New Glenn NG-2 will carry NASA's ESCAPADE twin spacecraft to Mars, marking Blue Origin's first paying customer mission and first interplanetary launch. But the revolutionary element isn't the rocket—it's the trajectory. Advanced Space, a Colorado aerospace company, engineered a mission profile that allows ESCAPADE to launch outside the traditional 26-month Mars transfer window by using the Sun-Earth L2 Lagrange point as a gravitational waystation. The spacecraft will loiter at L2 for one year, then execute a powered slingshot maneuver in November 2026 to reach Mars in 2027.

This breakthrough collapses the constraint that has throttled Mars exploration for six decades. Missions can now launch every Earth year rather than waiting for planetary alignments. The implication: establishing sustained Mars presence shifts from a multi-decade timeline to potentially a single decade.

Blue Origin completed a hotfire test on October 30, 2025, firing all seven BE-4 engines for 38 seconds, simulating the landing burn sequence required for booster recovery. CEO Dave Limp confirmed the company has "several more New Glenn boosters already in production," signaling confidence in operational cadence. If the booster successfully lands on the autonomous barge Jacklyn, New Glenn will join Falcon 9 as the second operational heavy-lift reusable rocket in history.

SpaceX Starship: The Final Version 2 Flight and What Comes Next

SpaceX completed Starship's 11th flight test on October 13, 2025—the final mission for the Version 2 iteration. Both the Super Heavy booster and Starship upper stage achieved controlled splashdowns, validating the full reusability architecture. The mission deployed mock Starlink satellites, executed an in-space Raptor engine relight, and performed dynamic banking maneuvers testing subsonic guidance algorithms for future return-to-launch-site operations.

SpaceX is now transitioning operations to Pad B at Starbase and finalizing Starship Version 3, the iteration designed for orbital flights and booster/ship recovery. William Gerstenmaier, SpaceX VP of Build and Flight Reliability, confirmed that at least one suborbital test of Version 3 will precede the first orbital attempt.

But here's where timelines compress dramatically. Elon Musk announced in May 2025 that SpaceX aims to launch five uncrewed Starships to Mars in the 2026/27 transfer window, contingent on demonstrating orbital refueling capability. If successful, the company plans approximately 20 missions in 2028/29, 100 missions in 2030/31, and up to 500 missions by 2033. Musk has outlined a goal of 1,000-2,000 Starships per Mars launch window by the late 2030s, each carrying 100-200 passengers.

Aerospace experts I've consulted find the architecture sound—Robert Moses, a retired NASA Langley engineer, stated, "He's checking all the boxes here that I would like to see checked." The uncertainty isn't the design; it's execution speed. Moses suggests that even if SpaceX misses 2026, launching uncrewed missions in 2028 "still gives him one more opportunity before 2033 to throw everything possible over to Mars."

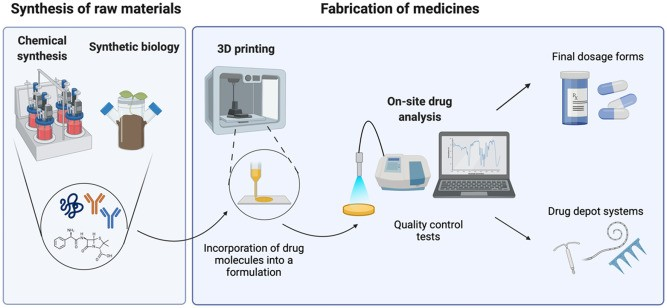

Pharmaceutical Manufacturing in Microgravity: From Concept to Industrial Scale

The most underreported revolution in space commerce is pharmaceutical manufacturing in microgravity—and it's now transitioning from experimental validation to operational production.

Varda Space Industries has completed three successful reentry missions recovering pharmaceutical payloads grown in orbiting bioreactors. The W-2 mission in February 2025 proved that continuous glucose monitors and insulin pens operate reliably during Mach 25+ reentry at extreme temperatures and vibration. More significantly, ritonavir HIV medication crystals grown in microgravity achieved pharmaceutical-grade quality superior to Earth-manufactured equivalents in bioavailability and efficacy.

The game-changing development: In October 2025, Varda and Southern Launch signed a 20-mission contract through 2028, establishing regular, scheduled reentry operations at Australia's Koonibba Test Range. Production costs have collapsed from ~$100 million per reentry to ~$5 million, according to Air Force Research Lab data—a 95% cost reduction making space-manufactured pharmaceuticals economically viable.

Parallel breakthroughs are accelerating the sector. During Axiom Mission 4 (Ax-4), Axiom Space and Burjeel Holdings completed breakthrough diabetes management research proving that commercial continuous glucose monitors and insulin pens function with Earth-comparable accuracy in microgravity. This opens spaceflight to the first astronaut with diabetes—historically a disqualifying condition—and validates commercial medical devices for long-duration missions.

SpacePharma's automated miniaturized microgravity labs have launched multiple platforms to the ISS, while developing large-scale orbital pharmaceutical manufacturing capabilities. The pharmaceutical sector represents high-value applications where cost-per-kilogram to orbit is justified by therapeutic and economic value of crystalline drug formations impossible to produce terrestrially.

Holographic Displays and Neuromorphic Computing: The Hidden Revolution

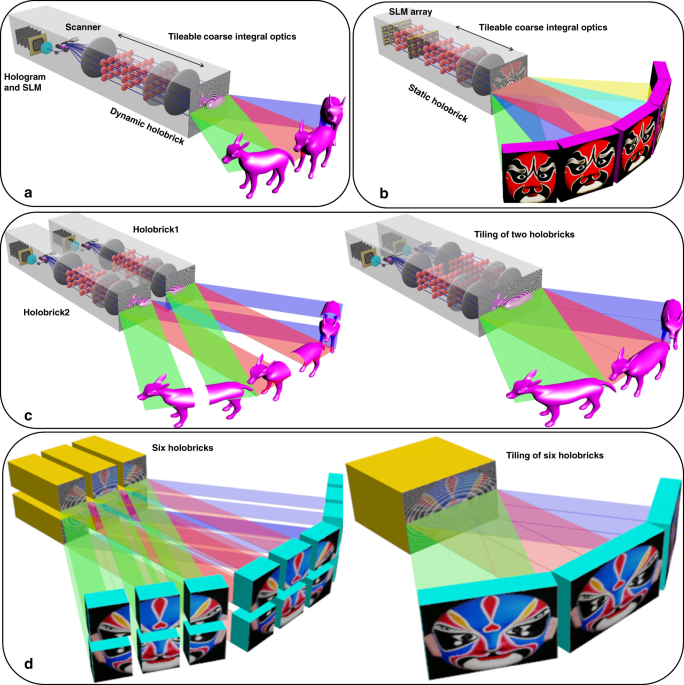

Two emerging technologies are converging to transform satellite capabilities in ways most analysts haven't recognized.

The University of St Andrews achieved a breakthrough combining Organic Light-Emitting Diodes (OLEDs) with Holographic Metasurfaces (HMs)—creating miniaturized holographic display technology operating without lasers. The innovation: a complete image can be projected from a single OLED pixel using nanoscale metasurfaces (meta-atoms each ~1/1000th the width of human hair), dramatically reducing power consumption compared to conventional multi-pixel holograms.

Why this matters: satellites transmitting high-bandwidth Earth observation data require increasingly sophisticated ground visualization. Holographic metasurface displays enable compact, low-power terminal equipment for distributed ground networks in remote environments. The holographic display market is projected to reach $53.79 billion by 2032 from $13.84 billion in 2025—a 21.4% CAGR driven largely by satellite communications integration.

Simultaneously, neuromorphic computing—processors mimicking biological neural architecture—is delivering 100 to 1000 times greater energy efficiency than conventional processors for specific tasks. Intel's Loihi 2 and IBM's NorthPole represent large-scale digital implementations, while breakthroughs in diffusive memristors (mimicking ion dynamics in biological neurons) are enabling compact, power-efficient autonomous decision-making.

For satellites where power is perpetually scarce, neuromorphic processors unlock continuous onboard learning: adapting to debris environments, dynamically routing inter-satellite communications, performing real-time Earth observation classification, and executing complex maneuvers without ground intervention. The neuromorphic market is projected to reach $8.3 billion by 2030, with China's Made in China 2025 initiative allocating $10 billion specifically for neuromorphic AI chip research.

Swarm Intelligence and Mega-Constellations

Harbin Engineering University, China Academy of Space Technology, and Stevens Institute of Technology demonstrated a paradigm shift in constellation design: a 891-satellite constellation achieving 35-minute global imaging capability through hierarchical swarm coordination.

Traditional constellations optimize for uniform coverage; this approach optimizes for response time using swarm optimization algorithms. Core satellites are surrounded by "supporting satellites" in coordinated formations that dynamically reposition as certain satellites exit view, maintaining continuous coverage while optimizing fuel and downlink scheduling.

This represents the transition from static constellation geometry to adaptive, AI-coordinated orbital swarms—essential as mega-constellations proliferate and collision avoidance becomes mission-critical.

Starlink dominates with over 7,300 operational LEO satellites delivering global broadband. Amazon's Project Kuiper launched production satellites in April and June 2025, targeting a 3,236-satellite constellation with operational service by 2025-2026. OneWeb, under Eutelsat Group, generated $216 million in LEO revenues for the 12 months ending June 30, 2025—approximately 15% of Eutelsat's total sales.

China's Galaxy Space has deployed 1,000+ small satellites in LEO constellations at 500-1,000 km altitude, providing 5G network coverage globally. Latvia's Mission Space operates custom nanosatellite constellations measuring near-Earth magnetic and solar storms up to 600 km altitude, providing predictive space weather monitoring for aviation, energy, and financial trading.

In-Orbit Servicing, Assembly, and Manufacturing: Building Infrastructure in Space

The ability to build, refuel, repair, and maintain satellites directly in orbit represents one of the most transformative capabilities emerging in space commerce.

NASA and Maxar Technologies completed critical design review for OSAM-1 in February 2025—a mission to demonstrate on-orbit refueling of Landsat 7, an Earth observation satellite launched in 1999. This first-of-its-kind demonstration establishes proof of concept for extending satellite lifespans through orbital servicing.

SpaceLogistics (Northrop Grumman) announced its first commercial Mission Extension Pod sale to Optus, Australia's largest satellite operator. The MEP propulsion augmentation device can extend a typical 2,000 kg GEO satellite's lifespan by six years, with robotic installation planned in 2025. The European in-orbit servicing market is estimated to reach €5 billion by 2030, growing at 11.5% annually.

Redwire's Additive Manufacturing Facility (AMF), operating continuously aboard the ISS since 2016, has manufactured over 200 tools, assets, and parts in orbit. The Redwire Regolith Print mission successfully demonstrated 3D printing with lunar regolith simulant, validating in-situ resource utilization for lunar construction. Redwire broke ground on a 30,000-square-foot microgravity payload facility in Indiana, signaling sustained commercial demand.

Axiom Space and Red Hat are launching an orbital data center demonstration aboard SpaceX CRS-33, testing on-orbit data storage and real-time processing. Future commercial space stations will require autonomous computing to process raw sensor data before Earth transmission—reducing downlink bandwidth and enabling latency-sensitive applications. This points toward satellite constellations with embedded edge computing, processing Earth observation and communications data directly in orbit.

Quantum Communications and Space-Based Unhackable Networks

As quantum computers threaten cryptographic systems globally, the space industry is deploying quantum key distribution (QKD) satellites creating unhackable communication infrastructure.

SEALSQ launched WISeSat 2.1 in June 2025, embedding the WISeKey Quantum RootKey—hardware-based root-of-trust using NIST-recommended post-quantum algorithms (CRYSTALS-Kyber and CRYSTALS-Dilithium) immune to both classical and quantum attacks.

China's Jinan-1 satellite achieved a 12,900 km quantum link between China and South Africa, enabling 1.07 million secure bits per second during a single pass—demonstrating space-based QKD at scale is operationally viable. SEALSQ plans six additional QKD satellites in 2025, while ESA's EAGLE-1 mission and China's expanding Micius network are establishing global quantum infrastructure.

Breakthroughs from the University of Technology Sydney demonstrated that quantum entanglement can be transmitted from Earth to satellites—overturning assumptions that "uplink" quantum communication was unfeasible. Ground station transmitters can access higher power with simpler maintenance while generating stronger signals, enabling future quantum computer networks using satellite relays.

Quantum sensing satellites offer parallel capabilities: quantum magnetometers detecting submarines by measuring magnetic-field distortions as small as 10^-15 tesla; quantum navigation systems achieving drift errors below 0.1 nautical miles in 72 hours—50 times better than current inertial systems, immune to GPS spoofing and jamming.

Space Debris Removal: From Crisis to Commercial Opportunity

The space debris crisis has transitioned from theoretical concern to active commercial mitigation.

Orbotic Systems won a NASA Phase II SBIR contract to develop RIDDANCE—an autonomous net-and-tether architecture combining autonomous detumbling to stabilize fast-spinning debris, net capture to secure targets, and passive descent using the D3 Deorbit Drag Device (eliminating fuel requirements). The system detaches after deorbit insertion, reusing the expensive servicer for multiple missions rather than burning it with each debris object.

Astroscale announced a breakthrough patent (US 12,234,043 B2) for multi-object debris removal using distributed shepherd vehicles. The system docks with debris, transfers it to a shepherd vehicle in lower orbit, then separates and engages a new client—enabling multiple large debris removals in a single mission while ensuring controlled reentry preventing harmful atmospheric fragments.

The regulatory imperative: The Orbital Sustainability Act (ORBITS Act), reintroduced in August 2025, mandates that NASA and FAA adopt uniform space debris standards, develop an "Orbital Debris Remediation List" of dangerous objects, and fund commercial debris removal partnerships. The legislation addresses the 63,000+ catalogued satellite payloads currently in orbit, with approximately 1,200 intact objects reentering atmosphere in 2024 alone.

Asteroid Mining: Legal Frameworks and Economic Realities

The space mining sector represents potentially the largest wealth transfer in human history—and the legal frameworks are finally solidifying.

The Space Resource Exploration and Utilization Act of 2015 (SPACE Act) grants US citizens engaged in commercial recovery the right to "possess, own, transport, use, and sell" any asteroid resource or space resource obtained. However, critical ambiguities remain: the absence of definitions for "commercial recovery" and jurisdictional clarity creates investment uncertainty.

The economic case is extraordinary. Nearly 9,000 asteroids larger than 150 feet orbit near Earth. Some individual asteroids possess upwards of $50 billion in platinum—more than South Africa's entire 2018 platinum production ($3.8 billion). Astrophysicist Neil deGrasse Tyson famously stated, "The first trillionaire will be the person who exploits the natural resources on asteroids."

AstroForge is leading commercial implementation. The company's Vestri mission, launching October 2025 on Intuitive Machines IM-3, will deploy a 440-pound probe to dock with a metallic near-Earth asteroid. With $55 million in total funding, AstroForge would become the first private mission to land outside the Earth-moon system.

The global space mining market was $1.90 billion in 2024, projected to reach $5.02 billion by 2030 at 17.9% CAGR. C-Type (carbonaceous) asteroids held 75% market share in 2024, valued for volatiles including water, ammonia, and carbon compounds essential for sustaining space habitats. S-Type (stony) asteroids offer higher metal content—nickel, iron, cobalt—critical for manufacturing applications.

However, economic analysis warns of market disruption. Researchers at Tel Aviv University simulated asteroid mining's impact, predicting one shipment of space minerals could devalue Earth gold prices by 50%, potentially triggering "global struggle for resources and power." Developing countries reliant on mineral exports—South Africa's platinum industry employs 451,000 people comprising 8.2% of GDP—face existential economic threats.

Lunar Mining: The Race for Water Ice and Rare Earths

The Moon's polar regions contain an estimated 6 trillion kilograms (6.6 billion tons) of water ice spread across approximately 1,850 square kilometers at each pole. This ice isn't just scientific curiosity—it's the foundational resource enabling sustained lunar presence.

NASA's PRIME-1 experiment launched on Intuitive Machines-2 in February 2025 to perform drilling demonstrations. Georgia Tech researchers developed a revolutionary method using concentrated solar reflected into receivers submerged in ice, extracting water by beaming sunlight off mirrors for miles with virtually no atmospheric attenuation.

The Aqua Factorem extraction method leverages the Moon's fractured regolith structure: ice crystals bound weakly to rock grains can be extracted through minimal energy using pneumatic, magnetic, and electrostatic separation—operating with low power in permanently shadowed regions (PSRs). The soil is 95-98% non-ice ("tailings") dropped in PSRs, while the desired 2-5% ice is transported to sunlight where energy is available for cleanup, electrolysis, liquefaction, and storage.

This approach transforms economics: rather than building massive infrastructure inside PSRs, minimal-mass rovers perform separation, then transport only the ice to sunlight—achieving extreme mass reduction making kilometers-long transport viable.

China confirmed this week that its Chang'e 7 spacecraft will launch in August 2026, targeting lunar water ice extraction demonstrations. China is positioned to beat the US to operational lunar water extraction, establishing strategic advantage in cislunar resource control.

Lunar Colonization Timeline: The Artemis Era and Beyond

NASA's Artemis program timeline (as of November 2025):

Artemis II (April 2026): Four astronauts on SLS/Orion perform lunar flyby—first crewed mission beyond LEO since Apollo 17.

Artemis III (Mid-2027): First crewed lunar landing since 1972, using SpaceX Starship HLS to land near the lunar south pole.

Artemis IV (September 2028): Docking with Lunar Gateway, delivering additional modules—third crewed lunar surface expedition.

Artemis V (March 2030): Blue Origin's Blue Moon lander delivers crew near pre-positioned Lunar Terrain Vehicle (LTV)—first lunar rover since Apollo 17.

Artemis VI (March 2031): Integration of Crew and Science Airlock Module with Gateway—fourth crewed surface expedition.

The Lunar Gateway space station—an international collaboration including Canada, Europe, Japan, and UAE—will assemble in lunar orbit across multiple missions. The first components (PPE and HALO) launch no earlier than 2025 on SpaceX Falcon Heavy, taking approximately one year to reach near-rectilinear halo orbit.

Gateway teaches humanity to live further from Earth than ISS's 250-mile orbit, establishing operational experience for eventual Mars missions. It serves as staging infrastructure: astronauts dock Orion to Gateway, transfer to lunar landers (Starship HLS or Blue Moon), descend to surface, then return to Gateway for Earth return aboard Orion.

Sustainable Moon Base: 2028-2032. Following initial Artemis landings, NASA and commercial partners will establish permanent infrastructure. Redwire's orbital manufacturing capabilities will anchor commercial space station operations post-ISS retirement (2031), with Axiom Station, Vast's Haven-2, Starlab, and Blue Origin's Orbital Reef competing for operational certification.

Commercial Lunar Landers: Firefly Aerospace's Blue Ghost achieved the first fully successful commercial soft-landing in March 2025, touching down upright and stable in Mare Crisium with 10 NASA instruments. Intuitive Machines completed its second landing on March 10, 2025 (though it tipped over). Impulse Space, founded by Tom Mueller (SpaceX's first employee), announced in October 2025 plans for a lunar lander capable of delivering 3 tons of payload by 2028 using the Helios kick stage.

Mars Colonization: SpaceX's Accelerating Timeline

SpaceX's Mars architecture, detailed by Musk in May 2025, outlines an aggressive but methodologically sound approach:

2026/27 Transfer Window: Five uncrewed Starships launch to Mars (50% probability), carrying Tesla Optimus robots to validate landing technology and begin resource surveys.

2028/29 Window: ~20 Starships launch—most carrying additional Optimuses to establish ground infrastructure and survey water ice, with at least one carrying human crew (first crewed Mars landing, potentially 2029).

2030/31 Window: ~100 Starships launch, ramping infrastructure development.

2033 Window: ~500 Starships launch, approaching operational colony cadence.

Late 2030s: 1,000-2,000 Starships per launch window, each carrying 100-200 passengers, transiting 80-150 days.

The goal: one million people on Mars using 1,000 Starships, establishing self-sufficiency within "seven to nine years" per Musk's 2024 statements. This requires harvesting CO2 from atmosphere, splitting into O2 and CH4 for fuel production, and using O2 plus nitrogen for breathable air. Water ice extraction from Martian subsurface provides propellant production capability and life support.

Aerospace experts find the architecture credible—the uncertainty is execution speed. Even delayed timelines (first crewed mission 2035-2040, permanent colony by 2050) represent humanity becoming interplanetary within a generation.

Space-Based Solar Power: Breakthrough Demonstrations

Space-based solar power (SBSP)—once dismissed as too expensive—is experiencing renewed momentum driven by launch cost reductions and technological breakthroughs.

UK startup Space Solar completed its 18-month "Cassidi" project in 2025, demonstrating critical technologies including wireless power transmission, in-space assembly, and ground receiver systems. The company's "Harrier" demonstrator validated power-beaming technology with 360-degree electronic beam steering eliminating mechanical components—critical for cost efficiency.

Solar panels in space deliver 13 times more energy than equivalent Earth-based panels due to absence of night, weather, and atmosphere. Space Solar plans megawatt-scale commercial deployment within five years, expanding to gigawatt-scale within twelve years.

Japan's OHISAMA mission launches in 2025, testing transmission of 1 kilowatt from a 180-kilogram satellite at 400-kilometer altitude using a 2-square-meter photovoltaic panel. The demonstration requires antenna elements spread over 25 miles to capture energy during the spacecraft's brief transmission window.

California's Aetherflux is launching satellites that will beam solar energy to Earth using lasers. Caltech's Microwave Array for Power-transfer Low-orbit Experiment (MAPLE) became the first device to wirelessly transmit power in space and send detectable signals to Earth in 2023.

The market case is compelling: SBSP provides 24/7 continuous clean energy unaffected by weather or day-night cycles, complementing terrestrial renewables while enhancing grid stability by supplying power where most needed. Analysts project SBSP could reach commercial viability by 2030.

Nuclear Propulsion: DRACO's Cancellation and What It Means

DARPA and NASA's Demonstration Rocket for Agile Cislunar Operations (DRACO)—a $499 million joint project to flight-test nuclear thermal propulsion in orbit by 2027—was cancelled in May 2025.

The reason? Economic realities shifted beneath the program. DARPA Deputy Director Rob McHenry explained: "When DRACO was originally conceived, that was pre-precipitous decrease in launch costs driven largely by SpaceX capabilities and continued decrease that Starship offers... As launch costs came down, the efficiency gain from nuclear thermal propulsion relative to massive R&D costs started to look like less and less positive ROI."

Nuclear thermal propulsion (NTP) offers specific impulse around 900 seconds—double chemical rockets but half that of ion thrusters. NTP promised two-to-five times greater efficiency than chemical propulsion with 10,000 times greater thrust-to-weight ratio than electric propulsion, enabling rapid cislunar maneuvers and fast Mars transits (cutting journey time in half).

However, SpaceX's operational success with reusable chemical rockets and Starship's mass-to-orbit capability rendered NTP's efficiency gains less compelling given developmental costs and regulatory complexity. Launch approvals for uranium enrichment below 20% (DRACO's "Tier 2" classification) required only agency head approval, but broader political and technical challenges remained.

Research continues: University of Alabama and Ohio State are developing Centrifugal Nuclear Thermal Rocket (CNTR) using liquid uranium fuel (rather than solid), promising to nearly double specific impulse of traditional NTP while maintaining similar thrust. The technology remains viable for specialized applications—just not near-term priority given chemical propulsion economics.

Space Weapons and Military Applications: The Contested Domain

Space has transitioned from passive observation platform to contested military domain. Several critical developments are reshaping space defense:

Directed Energy Weapons (DEWs): High-power lasers and microwave systems provide rapid-response capability against missiles, drones, and enemy satellites. AeroVironment's $4.1 billion acquisition of BlueHalo consolidated IP and expertise in high-power microwave weapons, potentially making commercial space vehicles dual-use platforms.

Hypersonic Weapons and Railgun Systems: Multiple US defense contractors are in advanced prototype testing for hypersonic vehicles capable of atmospheric deployment from orbital platforms, promising ultra-fast kinetic strikes with global range. Electromagnetic railgun systems use electromagnetic propulsion to fire projectiles at extremely high velocities without chemical propellants—ideal for rapid, precise orbital engagements.

Stratolaunch's Talon-A family achieved multiple hypersonic milestones:

TA-1: First powered hypersonic flight (Mach 5+) completed 2024

TA-2: First fully reusable version exceeded Mach 5 in multiple Pentagon-backed tests in 2025, with successful recovery and rapid re-flight

TA-3/TA-4: In development, TA-3 first flight planned late 2025

A-Z: Larger vehicle projected to reach Mach 10 speeds

Orbital Warfare Concepts: "Swarm satellites"—coordinated groups of small spacecraft acting as collective defense/offense units to overwhelm adversary systems. Concepts include kinetic kill vehicles piggybacked onto cubesats and autonomous defensive countermeasures protecting national assets.

The Golden Dome Initiative: This defense-focused policy incentivizes commercial companies to develop rapid-deployment satellite capabilities, modernize LEO constellations, and create micro-satellite swarms. The initiative recognizes that commercial innovation—when aligned with national security imperatives—accelerates capability development while distributing risk.

US, China, and Russia have confirmed developmental programs for small satellite-based weapons platforms focusing on electronic warfare, cyber interference, and kinetic strike capability integrated with commercial constellations. Space is now acknowledged as a contested military frontier requiring robust command, control, and operational resilience.

China's Commercial Space Emergence: State-Driven Competition

China has deliberately fostered commercial space since 2014 through escalating policy support:

2014: State Council opens Earth observation and launch to private investment 2015: National call for commercial space innovation 2019: Enhanced regulatory clarity for commercial launch 2022: Expanded procurement and R&D project access 2023: Commercial space designated "strategic emerging industry" 2025: CNSA begins development plan strengthening commercial space 2026-2035

This catalyzed hundreds of venture-backed startups including:

GalaxySpace: Mass-produces modular smallsats, deployed 1,000+ satellites

LandSpace and Galactic Energy: Commercial launch providers

Tianqi: LEO IoT constellations

Chang Guang Satellite: Remote sensing

Commsat and Geespace: LEO satellite platforms

However, structural constraints limit strategic autonomy. Most companies remain dependent on government contracts, indirect subsidies from state-affiliated capital, and alignment with Belt and Road Initiative objectives. China's 9% share of global active satellites in 2024 is expected to grow, positioning China as significant long-term competitor despite limitations in global market access.

Private Space Stations: The ISS Succession

As NASA targets ISS retirement by 2031, four commercial contenders compete for NASA Commercial Low Earth Orbit Development (CLD) certification:

Axiom Station: Most advanced—three crewed ISS missions completed. First module (AxPPTM) attaches to ISS in 2027, Habitat 1 launches 2028. Accelerated timelines maintain competitiveness.

Vast's Haven-2: Dark horse potentially matching Axiom's timeline with modular station capability.

Starlab: Single-module station by Nanoracks launching aboard Starship in 2029—achieving full operational capacity instantly upon launch.

Orbital Reef: Blue Origin/Sierra Space collaboration faces delays, with preliminary design review pushed to mid-2024 and sparse progress updates.

Commercial space stations will integrate anchor tenants: Redwire's manufacturing platform, pharmaceutical production facilities, edge computing infrastructure, and in-orbit servicing hubs—establishing genuine orbital industrial capacity.

The Investment Landscape: Venture Capital Meets Space

Q3 2025 saw 727 space-related deals globally across infrastructure, robotics, defense, and data applications. First-half 2025 deal value reached $3.3 billion across 166 deals, with full-year trajectory potentially exceeding 2024's $6.6 billion.

Critically, investors favor "late-stage" deals (~41% of investments), reflecting maturation from speculative ventures toward revenue-generating enterprises. Corporate venture capital, especially from aerospace primes, bridges innovation and procurement, recycling capital while validating valuations and accelerating commercialization.

Intellectual property in space is surging: patent applications disclosing space inventions grew 144% between 2003-2023—four times larger than overall patent growth. The private sector now dominates: 84% of US space patents in 2023 came from private entities without government support (up from 65% in 1976-1993). Small companies, universities, and nonprofits account for ~40% of all US space patents, reflecting democratization driven by venture capital and declining development costs.

Regulatory Evolution: Law Struggles to Keep Pace

FAA Restrictions During Government Shutdown: The FAA issued an order (November 2025) restricting commercial launches/reentries to 10 PM - 6 AM local time to "ensure safety and efficiency" as government shutdown stretches into its second month with air traffic controllers working without pay. This constrains SpaceX (100+ launches in 2025), ULA, and Blue Origin—timing is critical for missions, and overnight-only windows could cause delays, increased costs, or missed launch opportunities.

Orbital Sustainability Act (ORBITS) mandates:

Orbital Debris Remediation List published within 90 days

Active Orbital Debris Remediation Demonstration Program funding

Uniform Orbital Debris Standards adopted by FAA/FCC

Space Traffic Coordination Standard Practices

UK Space Sustainability Standards (BSI Flex 1969/1971) address design through decommissioning, establishing frameworks for end-of-life disposal, constellation design, and collision mitigation.

Spectrum Regulation Tensions: FCC's March 2024 rejection of SpaceX's spectrum modification petition highlights ongoing complexity. SpaceX sought 1.6/2.4 GHz and 2 GHz bands occupied by legacy "Big LEO" operators. While immediate application declined, FCC acknowledged broader rulemaking on spectrum sharing warranted—suggesting future regulatory flexibility as congestion intensifies.

IP Law in Space: The Outer Space Treaty (1967) and national IP laws provide only loose frameworks. Jurisdictional ambiguity complicates enforcement across national space objects. Current treaties lack meaningful enforcement provisions. Companies operating in-orbit services, manufacturing platforms, and multi-national ventures face uncertain IP protection, necessitating contractual clarity and creative jurisdictional strategies.

The Feasible Future: 2025-2050 Projections

2026-2027: First uncrewed Starships reach Mars. Blue Origin establishes operational New Glenn cadence. Varda completes 20 pharmaceutical reentry missions. First quantum satellite network becomes operational.

2028-2030: Artemis III lands humans on Moon. Lunar Gateway operational. Commercial space stations replace ISS. First sustained lunar water ice extraction. SpaceX launches 20+ Mars cargo missions. Neuromorphic satellites enable fully autonomous orbital operations.

2031-2035: Permanent lunar base with 12-50 person rotating crew. First crewed Mars landing (likely 2029-2033). Asteroid prospecting missions return samples. Space-based solar power reaches commercial pilot scale. In-orbit pharmaceutical manufacturing generates $5+ billion annual revenue.

2036-2040: Lunar colony reaches 100-500 people with in-situ resource utilization providing propellant and construction materials. Mars base established with 50-200 people. First asteroid mining operations extract platinum-group metals. Launch costs drop below $100/kg enabling mass orbital manufacturing.

2041-2050: Mars colony reaches 1,000-10,000 people moving toward self-sufficiency. Lunar population reaches 1,000+. Asteroid mining becomes major economic sector with multiple operational facilities. Space-based solar power contributes meaningful percentage of Earth's energy. Orbital manufacturing produces advanced materials, pharmaceuticals, and semiconductors impossible to create terrestrially.

Most Feasible Outcome: Gradual, accelerating commercialization punctuated by breakthroughs. Launch costs continue declining (Starship reaching $50-100/kg by 2035). Lunar presence becomes sustained by 2032. Mars sees first crewed landing 2033-2035, with small permanent base by 2040. Asteroid mining proves technically viable but economically marginal until 2040s. Space-based solar power reaches commercial viability 2035-2040. Space economy reaches $1.8 trillion by 2035, $5+ trillion by 2050.

Humanity's Inflection Point

The privatization of space represents one of the most significant economic and civilizational transitions in human history. What began as government-exclusive domain has transformed into a commercial ecosystem where private capital, entrepreneurial innovation, and competitive market forces drive capability development faster than centralized programs ever achieved.

The space economy's trajectory from $630 billion (2023) to $1.8 trillion (2035) isn't speculative projection—it's momentum already underway. Launch costs have dropped 95%+ in four decades. Pharmaceutical manufacturing in orbit has transitioned from experiment to industrial production. Quantum communication satellites are deploying unhackable networks. Debris removal has evolved from theoretical concern to commercial service. Lunar water ice extraction will begin operations within 24 months.

The most profound shift isn't technological—it's philosophical. For the first time in history, humanity is developing off-world industrial capacity independent of Earth's biosphere. Orbital pharmaceutical factories, in-space manufacturing facilities, asteroid mining operations, and lunar resource extraction create production chains that begin and end beyond Earth's atmosphere.

This isn't science fiction deferred to distant futures. It's operational infrastructure being built right now by companies with paying customers, validated technology, and established supply chains. Blue Origin launches paying customers to Mars this week. SpaceX will launch 100+ rockets in 2025. Varda is completing its 20-mission pharmaceutical contract. Firefly achieved the first successful commercial lunar landing. The transition is complete.

The question isn't whether humanity becomes spacefaring—that's already happened. The question is how quickly the infrastructure scales, how broadly access democratizes, and whether governance frameworks evolve fast enough to manage the transformation.

Based on current trajectories, by 2050 there will be permanent human settlements on the Moon and Mars, operational asteroid mining, space-based solar power contributing to Earth's energy grid, and orbital manufacturing producing materials impossible to create terrestrially. The space economy will exceed $5 trillion annually, employing millions, and fundamentally reshaping Earth's economy and environment.

We're living through humanity's transition from single-planet to multi-planetary civilization. The infrastructure being built today—by private companies, venture capital, and entrepreneurial engineers—will define civilization's trajectory for centuries. The space frontier isn't opening. It's already open. And the race to build its infrastructure has never been more intense.

Comments